Times of uncertainty in the global economy

As central banks increase their gold reserves, gold is making new highs.

Gold prices have touched record highs; currently, the gold prices stand at US$2,381 per OZ, which is a 15.5% increase since the start of this year.

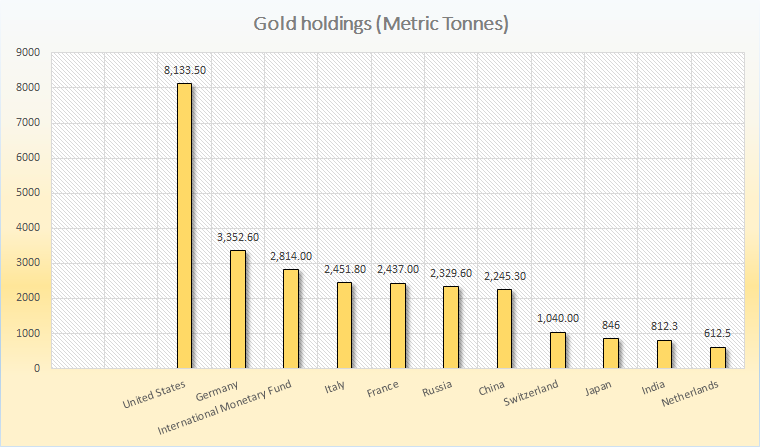

Smart money is moving towards gold, with central banks around the globe having started buying up gold, with China leading the front. The exhibit below shows the current gold reserves of the top 10 countries with gold holdings as of March 2024.

WHY?

High inflation is there to stay, making the global interest rates high. High interest rates discourage consumer spending, raising the risk of recession among the business community and investors.

Oil prices have substantially risen in the past few months, adding to the effect of raising inflation further.

Rising global conflict and geo-political tensions in the Middle East might impact oil and gas trade routes (Strait of Hormuz) while Russian oil and gas are still under sanctions and greatly disrupt the global supply chain.

China’s central bank, the People’s Bank of China (PBC), bought 225 metric tonnes in 2023. Currently, they have 2,245.30 tonnes of gold in their reserves.

Why is China doing it?

It might be because China has seen how Western countries have frozen the reserves of Russia following the Ukraine and Russia war. Though China still holds huge forex reserves of more than 3 trillion US $

With the imploding Chinese economy, Beijing might look for some misadventure down South in Taiwan from the lessons learned from Russians.

China has more than 2,200 tonnes of gold, which is an increase of ~16% from 1,948 tonnes in October 2022 to 2,200 tonnes in March 2024.

India has also increased its gold reserves, which now stand at 812.3 tonnes, and total Forex reserves stand at an all-time high of 648.5 billion US$. Gold reserves make up 8.5% of the total forex reserves, and this gold is worth about 55 billion US $.

Central banks worldwide are managing risk in these challenging and uncertain times.

Usually, the US $ and the dollar are inversely proportional when they appreciate, but we are seeing currently that both the dollar and gold are appreciating. The dollar is increasing due to high interest, and gold is rising as the demand for gold has increased, and it acts as a hedge or safe haven in these unpredictable and uncertain times. Smart money is moving towards safety and trying to lower its risk of losing capital.

Another weird thing is that stock markets worldwide are touching their new highs despite interest being high due to high inflationary pressure, even with the rising chances of economies going into recession. Various economists think the Fed may induce a recession to put inflation under control. We can not say what might happen, but the global economy is heading for great turbulence.

If you have read it this far, thank you!! Do share it if you liked the post, and do not forget to leave a comment.